As inflation continues to stretch budgets and elevate the cost of living, donors may find themselves re-evaluating how, and how much, they can give to the causes they care about. At the same time, nonprofits are feeling the effects of changing economic conditions and ambiguity around federal funding, so they will need to rely on individual donors more than ever. If generosity is core to your values but fiscal uncertainty is prompting you to assess your charitable giving, here are some strategies to consider:

Prioritize Mission Alignment

When resources are tight, focus your giving on organizations whose missions resonate most deeply with your values. Instead of spreading donations thinly across many causes, consider concentrating your support to a small number of nonprofits or Community Foundation funds that align most closely with what matters to you and give year after year. This not only amplifies your impact but also helps organizations strategize more effectively with predictable funding.

Shift to Recurring Giving

Take advantage of monthly or quarterly donation options via electronic fund transfer (EFT) or credit card. It’s an easy way to make philanthropy part of your budget and it provides nonprofits with a reliable revenue stream. If you have a donor-advised fund (DAF) at the Community Foundation, you can set up recurring grants as well.

Maximize Tax Benefits

Smart tax planning can help offset the cost of giving. Explore options like DAFs, gifts of appreciated stock or qualified charitable distributions (QCDs) from retirement accounts. These vehicles can offer tax advantages while supporting your philanthropic goals.

Stay Engaged and Informed

Connect with the organizations you support. Attend events, volunteer your time, read newsletters and follow them on social media. Keep atop of community needs using resources like

CNYVitals.org. Understanding evolving needs and challenges can help you tailor your contributions more effectively and deepen your sense of purpose in giving.

Reassess Periodically

Economic conditions change and so should your giving strategy. Make it a habit to review your charitable contributions every few years. Reflect on which organizations made the most meaningful use of your support and whether your financial situation calls for adjustments. Include charitable giving in conversations with your tax advisor or financial planner. This proactive approach ensures your philanthropy remains both sustainable and effective.

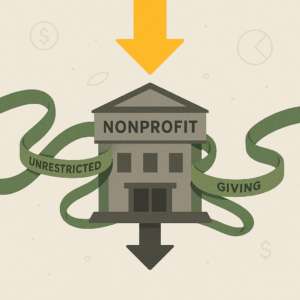

How Economic Conditions Are Affecting the Social Sector

Inflation is hitting nonprofit organizations with a double punch: rising costs and shrinking revenue. Unlike for-profit businesses, nonprofits can’t simply raise prices to offset expenses. They rely on donations, grants and contracts that often remain fixed even as their operating costs climb. According to the Nonprofit Finance Fund’s 2025 national survey, 84% of nonprofits with government funding expect cuts, and 36% ended 2024 with an operating deficit — the highest in a decade (Nonprofit Finance Fund, 2025 https://nff.org/learn/survey). Though some donors prefer not to support overhead costs or operating expenses, and instead gravitate toward programmatic giving, this is a critical time to lean in and support nonprofit infrastructure with unrestricted donations.

Inflation is hitting nonprofit organizations with a double punch: rising costs and shrinking revenue. Unlike for-profit businesses, nonprofits can’t simply raise prices to offset expenses. They rely on donations, grants and contracts that often remain fixed even as their operating costs climb. According to the Nonprofit Finance Fund’s 2025 national survey, 84% of nonprofits with government funding expect cuts, and 36% ended 2024 with an operating deficit — the highest in a decade (Nonprofit Finance Fund, 2025 https://nff.org/learn/survey). Though some donors prefer not to support overhead costs or operating expenses, and instead gravitate toward programmatic giving, this is a critical time to lean in and support nonprofit infrastructure with unrestricted donations.