Last year, we received a $10 million bequest from Bob Vitkus, a successful oral surgeon. This gift created a permanent fund that will support the causes important to Bob year after year. As we shared this story throughout the community, a question that came up often was how grant spending from funds such as this one actually works. This is a common inquiry I answer for donors (including Bob) when creating their fund or legacy plan.

It begins with understanding the mechanisms of a permanent fund. When a fund is created to last forever, it has two main objectives: keeping pace with inflation and making grants each year. Both of these goals require the fund to be invested. The Finance Committee of our board, advised by our investment consultant, is responsible for our investment choices and policies.

Since the Community Foundation has been around for over 90 years and looks forward to many years to come, keeping up with inflation is critical. Also, we want to maximize the amount of grants available from each fund since supporting nonprofits is the whole reason a fund is created. Our Finance Committee evaluates these factors each year and has historically allocated 4 to 5% of each fund’s balance as the amount available for grantmaking annually.

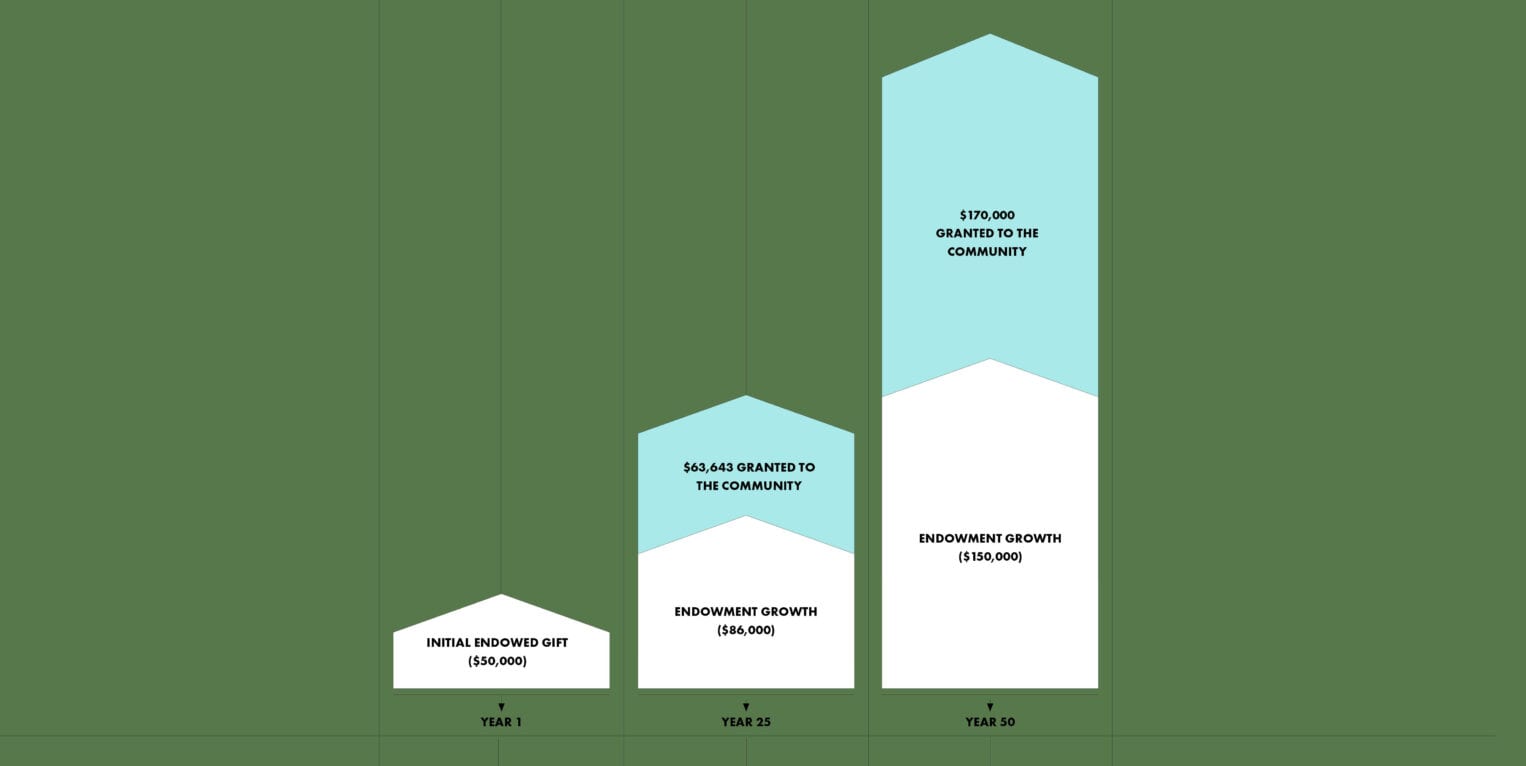

For example, a fund established with a $50,000 gift can grow exponentially assuming a 4% annual spending rate and a 7% rate of return. By year 25, the endowment’s value could grow to more than $86,000 and have already granted out $63,643 to the community. By year 50, those numbers could grow to an endowment value of $150,000 and more than $170,000 in grants awarded! Keeping pace with inflation makes each permanent fund as effective 50 years from now as it is today. Stewardship of the assets entrusted to us is one of our most important responsibilities.

Most of the funds at the Community Foundation are permanent funds and the majority are designated for specific nonprofits or scholarships. However, some of the permanent funds are for the greatest current needs of our community or, like Bob Vitkus’s fund, are for fields of interest. These more broadly supportive funds are what our community investment team deploys in our two Community Grant rounds each year and our initiatives such as Black Equity & Excellence. Over time these funds support many different nonprofits, since the most pressing needs in an interest area today may not be the same two years or two decades from now. We monitor the progression of each fund’s interest area and fund organizations whose services are making the greatest impact.