A U.S. Trust study found that people want their financial advisors to ask them about charitable giving. In fact, a third of clients surveyed think the topic of charitable giving should be raised in the very first meeting. Yet fewer than half feel their advisors are good at discussing personal or charitable goals with them.

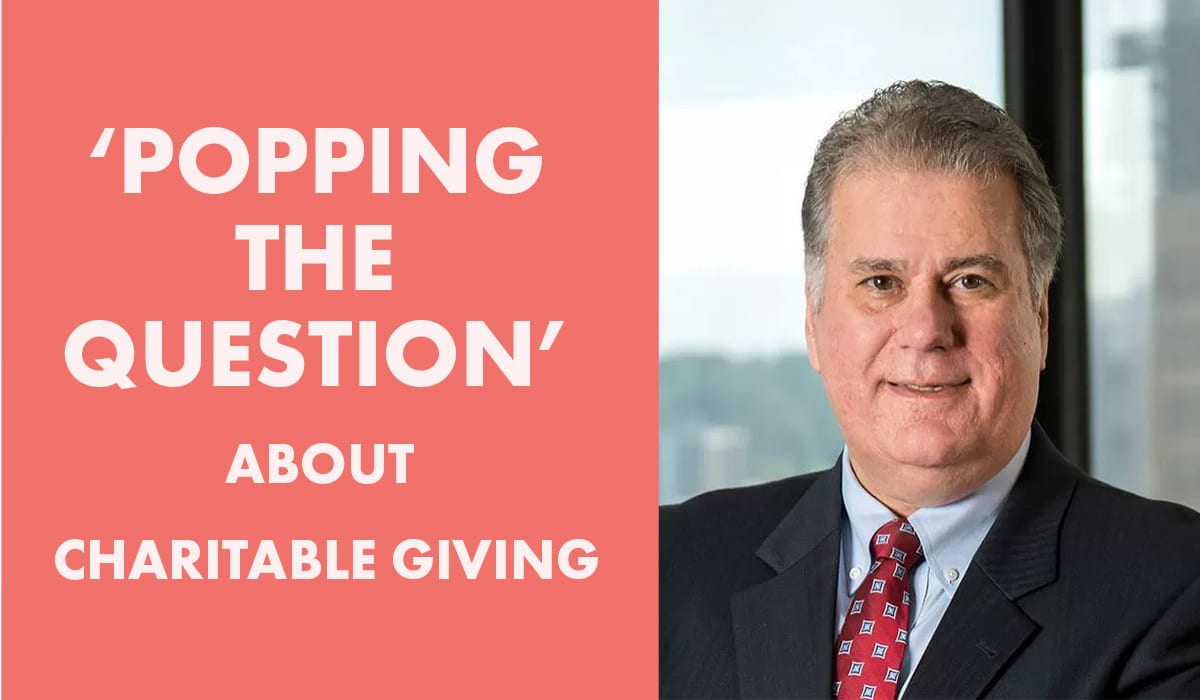

Wondering how to start a conversation about charitable giving with your clients? Or looking to refresh your approach? As part of an ongoing series, we’re asking some of Central New York’s most experienced professional advisors how they “pop the question” about charitable giving to their clients. Hear from Martin A. Schwab, Esq., Partner, Bond Schoeneck & King PLLC, on how he “pops the question.”

Why do you think it is important to bring up the topic of charitable giving?

As an estate planning attorney, it is important to discuss charitable giving in terms of both how clients wish to dispose of their estates and how they use charitable gifts to reduce estate and income taxes. Many clients have made charitable gifts during their lifetime and recognize that their estate plan is another opportunity to continue giving. Others tend to favor family over charity but they will include charitable giving once they understand the tax saving opportunities available to them.

Over the last 20 years, the federal and New York State estate tax exemptions have increased substantially thereby significantly reducing the estate tax obligations of many families. I point this out to clients and ask them to consider using some of these tax savings to fund charitable gifts at their passing. I have many clients with substantial retirement accounts. Given the passage of the SECURE Act in 2019, many of their beneficiaries would face large tax bills if forced to take withdrawals from their retirement accounts over 10 years as required under the SECURE Act. Thus, it may be advantageous to make gifts either during life or at death from those retirement accounts.

Although it is common for people to leave gifts in their will, where estate tax savings are not an issue, it is sometimes better to have a surviving spouse or family member make the gift to obtain an income tax deduction. There are many ways to make charitable giving tax efficient.

How do you learn about your client’s charitable interests?

I primarily learn about a client’s charitable interests through conversations with them along with any prior charitable giving included in their planning. If the client is new to me, I would ask about charitable giving when we talk about the disposition of their assets under their wills or retirement plans.

At what point(s) in your process do you bring up/revisit the topic of charitable giving?

With new clients, the topic of charitable giving usually comes up when discussing the disposition of their assets at passing. If they do not mention it, I would ask them to make sure they have considered it. If they share their existing documents with me that will be changing, I will review them. If charitable gifts are included in their plan, I will discuss whether they still make sense. I understand that people’s goals change over time so I revisit the topic from time to time.

What questions or ideas about charitable giving do you find resonate the most with your clients?

With many clients, asking them how they wish to give back to their community or how they would like to be remembered are good ways to initiate these conversations. Many of my clients have been fortunate and wish to help those less fortunate. Many are also interested in endowment type giving whether it includes giving to a specific organization with the funds dedicated to one of its missions or something more general that helps the community on a long-term basis or as the needs evolve over time. Providing a permanent funding base seems very appealing to many of my clients as opposed to a small gift that will be used immediately.

How has your approach changed over the years?

Over the years, I have taken the initiative more often to have clients consider charitable giving and make it part of their estate plans. Charitable giving is often overlooked by advisors and many clients are not aware of the current tax planning opportunities that allow them to benefit both their family and their favorite charities. I also strive to have clients think beyond the standard gifts to the college or university they attended or other natural recipients. I ask them to consider the impact their gift can have on the community they live in. Our community, like many others, has significant evolving needs and charitable giving to local nonprofit organizations can be a way to meet those needs.

Is there anything else you want to add about helping your clients with their charitable planning?

Central New York is fortunate to have a Community Foundation that is robust and active in addressing the significant needs and issues in the community. It has a broad view of the needs of the community and also has the resources to make a significant impact. The Community Foundation offers various flexible charitable planning options for donors and has dedicated staff who offer comprehensive service to donors.