Impact Investing

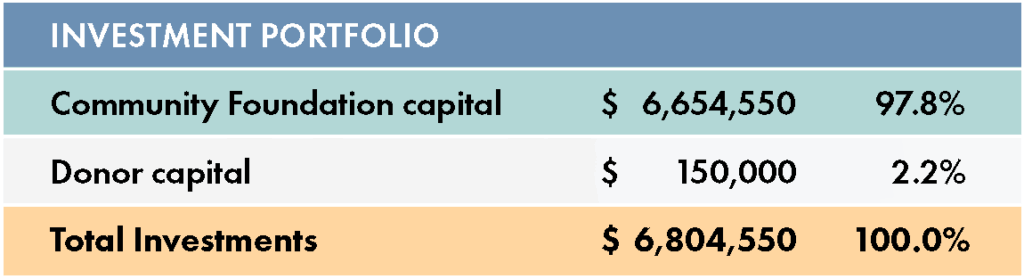

Impact investing allows us to use our financial resources to make investments that generate both financial returns and positive social outcomes. In 2023, our board of directors approved a policy that allows us to use up to 5% of our main investment pool for the purpose of local impact investment. By leveraging financial resources and investing in organizations and projects that align with our mission, we are able to make the most of our capital assets while contributing to the long-term well-being and development of our community.

$6.65M Invested in Region

$31.6M Leveraged for Home Loans

$37.6M Leveraged for Personal, Business & Other Loans

66 Low-Moderate Income Homes Constructed or Rehabilitated

2,433 Residents Received Legal Aid

Investment Spotlight

New Line of Credit Opened for Dunbar Association Deal

In December, we closed on a $450,000 deal to secure a low interest line of credit for the Dunbar Association. This investment enabled Dunbar to install a new HVAC system. These critical upgrades were needed to maintain the comfort and safety of visitors while the organization awaited reimbursement from a state grant contract. The Dunbar Association is a Syracuse-based community center that serves families, youth and seniors by hosting a wide range of programs and gatherings.

Without the new boiler, Dunbar reported it would have been forced to cancel programming during the winter months. The upgraded HVAC controls and air conditioning have also ensured the building remains a safe and comfortable space in the summer. The new system is also expected to reduce energy costs.

Our local impact investing program is designed to help organizations such as Dunbar continue essential services despite funding delays. A 2023 survey of local nonprofits found that 58% experienced delayed reimbursements from New York State grants. Through our impact investing efforts, we are helping local organizations bridge critical funding gaps and sustain vital community programs.