Delayed payments to nonprofits from New York State contracts has been an issue since the 1980s. Yet, despite decades of awareness and a multitude of course corrections, frustratingly little progress has been made to remediate this situation, which often results in financial hardship for Central New York nonprofits. In our latest issue paper, we examine how often this occurs, what steps nonprofits are forced take to make up the difference, and recommend a new solution that may be helpful in some circumstances.

Written by Colby Cyrus, CAPM, Program Manager and Frank Ridzi, Ph.D., Vice President, Community Investment

Download as PDFThe Wait

New Yorkers across the state benefit from the services that nearly 119,000 nonprofit organizations provide them on a daily basis (IRS, 2023). But these services come at a cost in terms of waiting for funds that take a long time to arrive. Nonprofits in general are always grappling with a question that never seems to go away: how can we pay for this? While organizations may offer fee-for-service programs, the reality is that most nonprofits need to rely on outside help to finance their work. A common solution for New York State (NYS) nonprofits is to contract with the state itself, by taking advantage of the countless funding opportunities the state has to offer (a quick review shows that there are about 32 state agencies that offer some kind of funding). While this may seem like a promising approach, there is one notable problem: when the money is awarded, it might not show up, sometimes for a very long time.

This isn’t a new problem. The issue of prompt payment has been on the state’s radar since roughly the mid-1980’s, and even resulted in the Prompt Contracting Law in 1991 (NYS Office of the Comptroller, 2014). Yet, despite decades of awareness and a multitude of course corrections, frustratingly little progress has been made to remediate this situation that often results in financial hardship for state nonprofits. To put this into perspective, the New York State Office of the Comptroller (OSC) reports that 58% of contracts were executed late in 2021, down slightly from 78% in 2020 (NYS Office of the Comptroller, 2022). For context, OSC’s most recent prompt contract report notes that “the [Prompt Contracting] Law outlines … prompt contracting time frames: 180 days from the state appropriation of funds for fully executed new competitive grant contracts, and 150 days for fully executed new noncompetitive or federally funded grant contracts.” (NYS Office of the Comptroller, 2021). This means that, when a contract is reported as being executed late, the funds were sent to the nonprofit at least 6 months after the contract was finalized.

It could be logical to assume that these figures are high due to the economic impact of the pandemic. However, in 2018 and 2019, OSC reports that 47% and 50% of contracts were executed late, respectively. So while COVID-19 may take some of the responsibility for the state’s delays, it is clear that this issue far precedes the pandemic.

It is clear, then, that state delays are forcing nonprofits to problem-solve in order to continue delivering their programs, which cuts into their already thin margins and operational capacities. With all of that in mind, we wondered what this situation might look like for nonprofits in Central New York. In an attempt to find out, we engaged partners in our five-county service area in a conversation, essentially asking “have you experienced delays? If so, what did that mean for you?” We also sought to find out how widespread this issue is, what nonprofits have done to try and correct it, and ultimately what they have done to mitigate the shortfall. This report summarizes what they told us as a result of our information-gathering.

The Experience

We had heard anecdotes from nonprofit partners over the years about how frustrating it was when state funding was delayed. Of course, that makes sense: when you know money is coming your way, you can begin to plan out how you want to spend it, and you might even front some of the costs in advance and then reimburse yourself with the impending award. When that check doesn’t come, however, you are left in a financially precarious situation. From what we heard, this was what was happening to local nonprofits.

In an attempt to get as much information as possible about this issue – and in order to identify the extent to which our nonprofit partners experience it – we began reaching out to nonprofit networks, such as the Human Services Leadership Council (HSLC) and CNY Arts, to see if they had insights. From there, the Community Foundation was able to develop and implement a survey, inviting nonprofit contacts in our database to participate and explain to us their experiences with contract delays (Cyrus 2023).

If it became clear that local nonprofits do, in fact, deal with these delays, we wanted to learn a few things:

1. Are there any patterns in terms of organizations who do – or don’t – go through it?

2. More importantly, what are the long-term effects of not getting the money in a timely fashion?

Our results show that, although far from a universal experience, 58% of respondents indicated that they have experienced delays when contracting with the state. That number represents 52 unique organizations to whom we talked about this issue. When we asked how long organizations typically wait, most of them – just over 50% – told us their waiting period is 1-3 months. While this falls slightly short of the 150 and 180 day thresholds that OSC has identified, waiting up to 3 months for promised payment can feasibly slow down programming to a dramatic degree. So, when this happens, how do nonprofits handle it? The most common stop-gap measure, about which we heard in our conversations even before this information-gathering, was that nonprofits would take out a line of credit to cover the costs – thus subjecting them to interest payments as well.

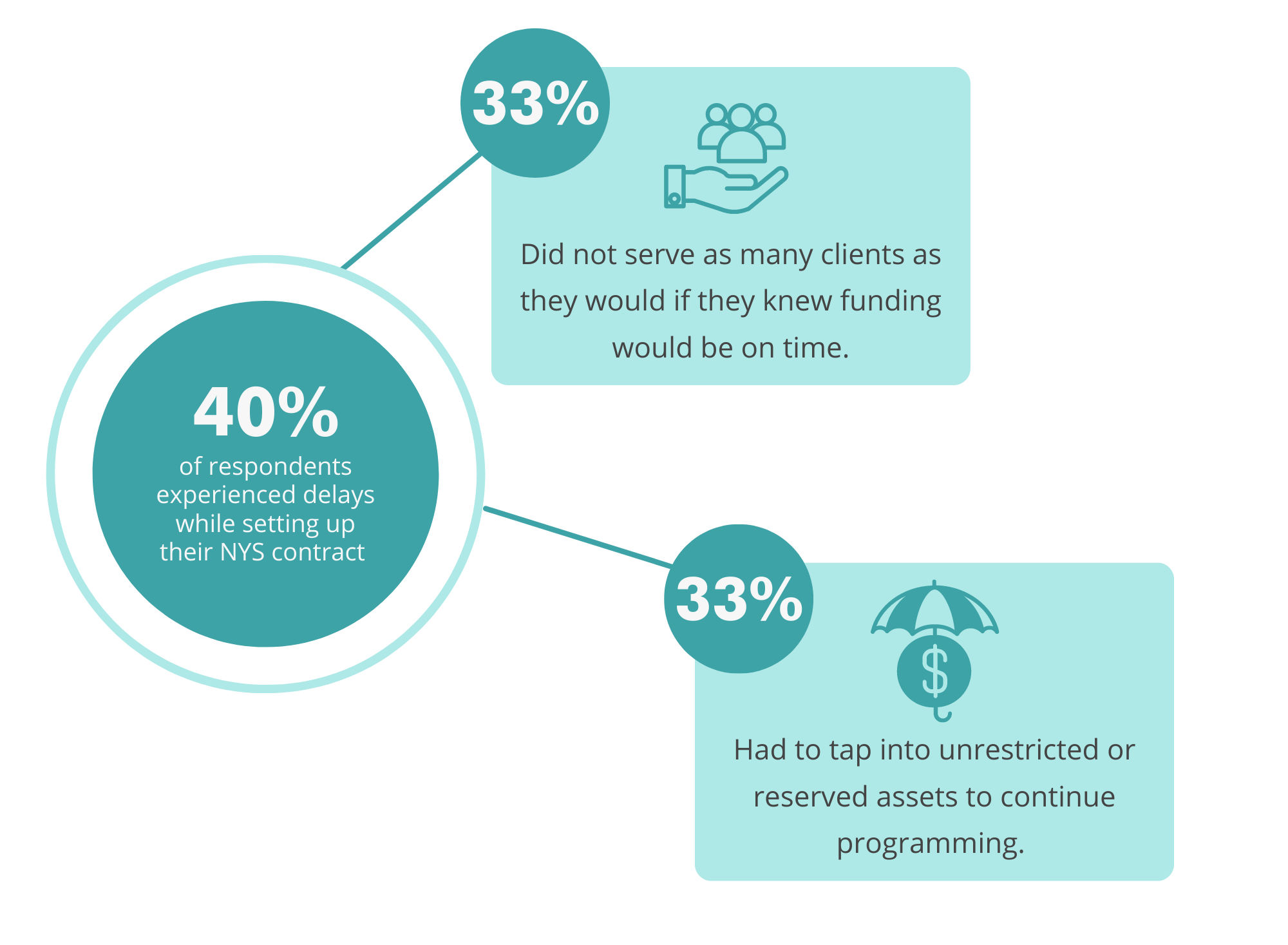

Twenty-nine percent of our respondents told us they took out a line of credit, while 43% reported having spent down some of their reserves to accommodate the funding delay. This is far from an optimal scenario, as research has shown that many nonprofits actually have less than 3 months’ worth of expenses available in their reserves to begin with (National Council of Nonprofits, 2022). By spending down some of those assets to account for a delay in receiving a contract payment, nonprofits ultimately have less resources on hand to deal with emergency situations. Having less reserves available, on top of not having their promised payment secured, just adds to the nonprofit’s precarious financial circumstances. And aside from issues in receiving the payments, it also seems that many nonprofits have a hard time even getting to that point. Forty percent of respondents told us that they had problems setting up the contract in the first place. This is often due to the process of getting the contract returned and ultimately approved. Doing so requires the nonprofits to provide a number of different budgets and work plans, which could be returned multiple times to the nonprofit in need of revisions before being finalized. All of this takes place largely within the Grants Gateway portal, which came up more than once in our results as being a cumbersome application that is not user-friendly. Although OSC and NYS have reported that the use of Grants Gateway has streamlined the process from beginning to end, some of our respondents still get hung up at this phase. These kinds of inconveniences can slow down the entire process, undermine the services organizations provide, and force them to serve fewer people or offer services at a loss.

The Way Forward

Both experience and data show that nonprofit organizations are compensating for NYS funding delays by taking out loans, altering services, and finding other stop-gap measures. We know from OSC data that typically over half of contracts are finalized late. Similarly, our own data shows us that it’s not uncommon for nonprofits in CNY to wait several months to receive their payments. All of this necessitates some kind of policy shift, a sustainable solution to a problem that has been lingering around since the 1980’s. While most of the fix will need to come from the NYS level, there are certain measures we can take in the meantime to address the funding shortfall. For community foundations across the country, one option is the flexible support offered in the form of impact investment. Defined as “any investment activity that intends to generate positive social and financial returns” (Council on Foundations), an impact investment is a type of charitable contribution that generates a financial return for the foundation on top of delivering benefit to the community through the recipient. Community foundations from Hawaii to Ann Arbor to Louisville have engaged in this kind of charitable giving. The Central New York Community Foundation’s impact investing loan strategy is our response to the needs that we have heard from local nonprofits, who are in need of cash while they wait for their money from the state to arrive. Though action at the state level is needed to solve the problem, an impact investment from CNYCF might provide the relief needed in the meantime.

So how does that work? As opposed to grants, which are made to organizations to carry out charitable work, impact investing consists of loans to local organizations that help to improve the community. These tend to be more of a short-term solution whereas grants focus more on sustainable impact felt well beyond the funding time period. And although impact investments can provide the needed relief, they are not a perfect solution. For example, depending on risk, foundations are likely to charge interest, which is a burden to the nonprofit and may require an intermediary financial institution, depending on the foundation’s capacity, which adds to cost.

Admittedly, impact investing is not the end all and be all in terms of fixing the decades-long issue of NYS contract delays. The final fix will come from Albany – but impact investing is a stop-gap measure rooted in flexibility. It allows foundations like CNYCF to meet the needs of recipients at a specific moment in time. It is essentially a bridge meant to help nonprofits continue their services in light of a funding shortfall. And in times when payment is pending, continuing services is always the first priority.

To learn more about CNYCF’s impact investing program, visit our impact investing page.

References

- Council on Foundations. Impact Investing. https://cof.org/content/impact-investing

- Cyrus (2023). A Look at New York State Funding Delays for CNY Nonprofits. Central New York Community Foundation.

- Internal Revenue Service (2023). Exempt Organizations Business Master File Extract (EO BMF). Available at https://www.irs.gov/charities-non-profits/exempt-organizations-business-master-file-extract-eo-bmf

- National Council of Nonprofits. Operating Reserves for Nonprofits. https://www.councilofnonprofits.org/running-nonprofit/administration-and-financial-management/operating-reserves-nonprofits

- State of New York Office of the Comptroller (2015). Prompt Contracting Annual Report Calendar Year 2014. https://www.osc.state.ny.us/files/state-agencies/contracts/pdf/prompt-contracting-report-2014.pdf

- State of New York Office of the Comptroller (2020). Prompt Contracting Annual Report Calendar Year 2019. https://www.osc.state.ny.us/files/state-agencies/contracts/pdf/prompt-contracting-report-2019.pdf

- State of New York Office of the Comptroller (2022). Prompt Contracting Annual Report Calendar Year 2021. https://www.osc.state.ny.us/files/state-agencies/contracts/2021/pdf/prompt-contracting-report-2021.pdf